الرسوم وفئات الدخل:

تم تحديد رسوم الخدمات المصرفية والإدارية للتمويلات من حيث فئات الدخل والرسم الذي يتحمله المقترض وفقا لما هو مبين أدناه:

- أقل من

401 ريال عُماني١٪ - من 401 –

1000 ريال عُماني٣٪ - أكثر من

1000 ريال عُماني٤٪

إشتراطات الحصول على التمويل:

إن اشتراطات الحصول على التمويل للطلبات في قائمة الانتظار في وزارة الإسكان والتخطيط العمراني وبنك الإسكان العماني وفقاً للإشتراطات الآتية:

أن يكون عماني الجنسية ومتزوج

أن يكون عماني الجنسية ومتزوج

لديه دخل شهري ثابت ومستمر يستطيع من خلاله سداد أقساط التمويل بشكل منتظم إلى البنك

لديه دخل شهري ثابت ومستمر يستطيع من خلاله سداد أقساط التمويل بشكل منتظم إلى البنك

أن لا يكون مقدم التمويل مالكاً لمسكن في السلطنة

أن لا يكون مقدم التمويل مالكاً لمسكن في السلطنة

أن لا يكون مقدم التمويل أو زوجه منتفعاً بنظام الإسكان الاجتماعي أو أي نظام إسكان حكومي مدعوم من قبل الحكومة، وألا يكون هو أو زوجه مستفيداً أو مستحقاً لأي تمويل إسكاني أو منحة سكنية مدعومة من جهة عملهما

أن لا يكون مقدم التمويل أو زوجه منتفعاً بنظام الإسكان الاجتماعي أو أي نظام إسكان حكومي مدعوم من قبل الحكومة، وألا يكون هو أو زوجه مستفيداً أو مستحقاً لأي تمويل إسكاني أو منحة سكنية مدعومة من جهة عملهما

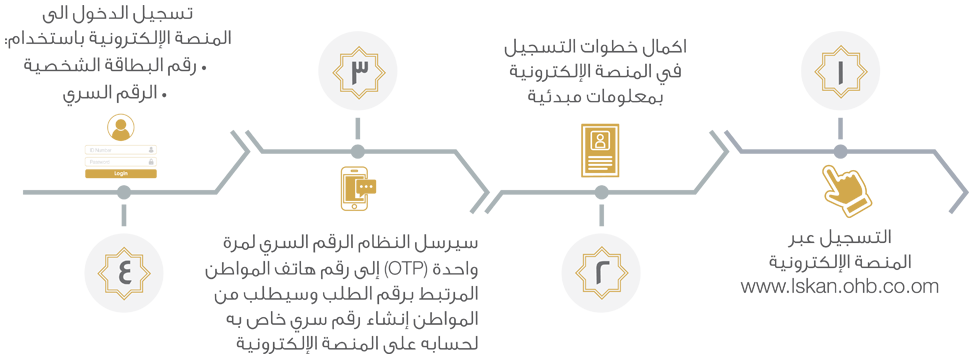

آلية سير العملية الالكترونية لمبادرة التعاون

بين القطاعين العام والخاص "إسكان':

يمكن لأي مواطن من أي موقع جغرافي الدخول إلى المنصة الالكترونية واستكمال اجراءات التسجيل لمعرفة دوره، هذه من ناحية، ومن ناحية أخرى معرفة هل هو من ضمن المستحقين للحصول على التمويل.

يقوم بنك الإسكان العُماني بتحميل قوائم المواطنين الـمـسـتـحـقيـن للـدور حسب الأقدمية وتحميلها في المنصة الالكترونية "إسكان" وإرسال رسالة نصية قصيرة بقرب وصول الدور لكل شخص مستحق، وستتضمن الرسالة النصية رابطاً ومن خلاله مباشرة العملية لتقديم الطلب عبر المنصة الإلكترونية لتنفيذ الإجراءات وفقاً لما هو مبين على الجانب الآخر:

ملاحظة

من خلال الدخول إلى المنصة الإلكترونية بإمكان المواطن المستحق للتمويل الإطلاع على موعد وصول دوره.

شركاؤنا الإستراتيجيين ضمن برنامج "إسكان"

رقم الاتصال

24775800

البــريد الإلكترونــــي

iskan@ohb.co.om

بنك الإسكان العماني ( ش.م.ع.م)